What is the driving force behind everything you do?

Go to school so you can find a job.

Find a job so you can make money.

Then you retire and theoretically spend your final days in bliss.

Now the problem is to make sure this all goes smoothly to ensure you have a comfortable retirement.

Realistic Problem

The vast majority of millennials are worried.

Social security might not exist for this generation.

However, this worry doesn’t translate into savings.

This is understandable, though.

With heavy loan debts and a difficulty to get by on a daily basis, the millennial budget might not have room for retirement funds.

Begin With Goals

Think about what you want your retirement to be like.

What is your definition of a “comfortable retirement?”

The style and standard of living you want obviously affects how much money you need.

It determines your target replacement income (TRI).

Your TRI should be the percent of your current income which you will live off later in life.

According to Bankrate, it is best to multiply this by 30 percent.

For example, if your TRI is 70 percent, 21 percent of your annual income should go to your retirement fund.

Make Room In Your Budget

Retirement is a long-term goal.

There are short-term financial goals as well.

Such as paying off student loans or buying a car.

Those might take top priority now.

But starting early with this furthest goal will give you much more flexibility.

So make sure you have room in your budget for these savings.

Understanding Interest

When you deposit money into a bank, you can earn interest.

It is a percentage of your deposit.

Usually, the more you put in, the more you earn.

There are two main types of interest for savings: simple (or nominal) and compound.

Simple Interest

A simple or nominal interest is paid only on your deposit.

For example, a 6.00% pa interest on $10,000 will give you $600 in interest per year.

There are no interest benefits.

Compound Interest

If the bank account earns a compound interest, the interest is added to your balance.

This means your own money will earn interest.

Your interest will also earn interest.

For example, take the same interest rate and deposit from above.

But the interest is paid monthly.

At the end of the first month, interest would be $50.96.

The interest for the next month would be based on $10,50.96 instead of $10,000.

By the end of the year, your balance would be $10,616.78.

Most retirement plans earn compound interest.

With time, the money earned would be much, much more than with simple interest.

Choosing A Savings Plan

Ultimately, this depends on your goal and what’s available to you.

Most employers offer profit-sharing plans.

The most common plan through an employer is the 401(k) plan.

It allows you to contribute a portion of your salary into your account.

Your employer can match contributions, which is virtually free money.

These deferrals are also excluded from taxable income.

For-profit organizations offer a 401(k) plan.

Teachers and employees of non-profit groups can be provided 403(b) plans.

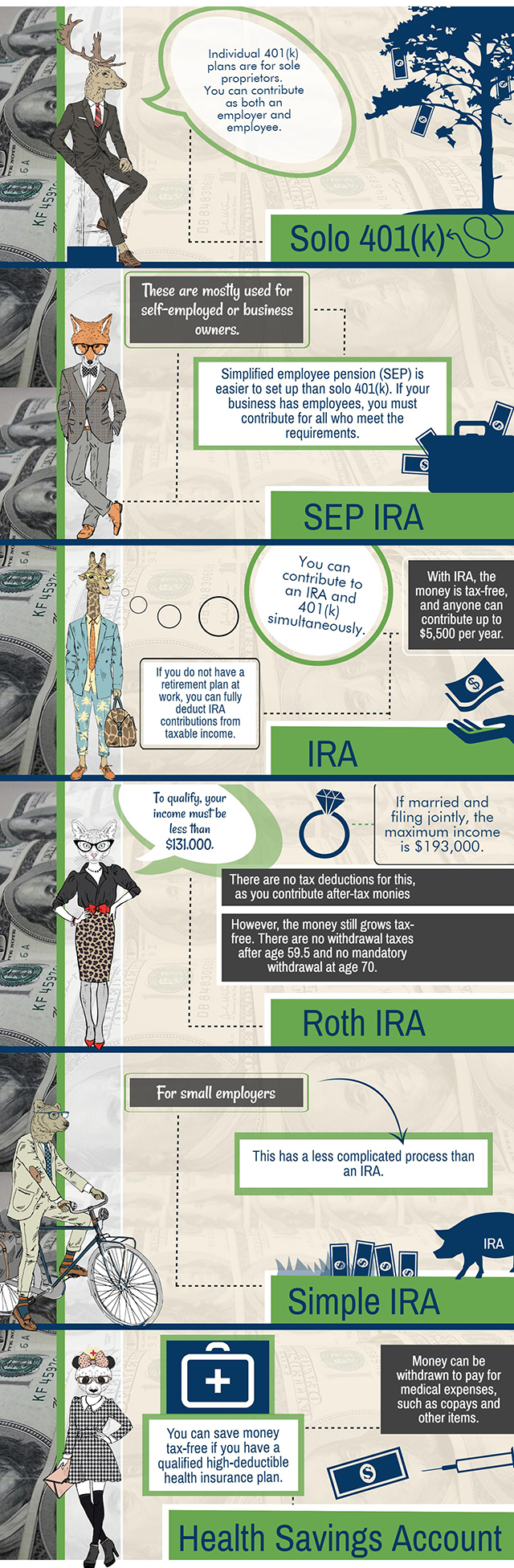

Other Types Of Plans

If you are self-employed or don’t like the 401(k) plan, there are more choices.

They are also a bit more complicated.

It is advised to consult an accountant or financial adviser.

Here are the other major types that exist:

For more details, please visit the official IRS website.

Understanding Accounts And Investments

An account determines how your money will be treated.

It’s really just a holding place for your investments.

There are multiple types of investments for your consideration: mutual funds, bonds, CDs, exchange-traded funds (EDF) and individual stocks.

Click here for more information on choosing the right investment plan.

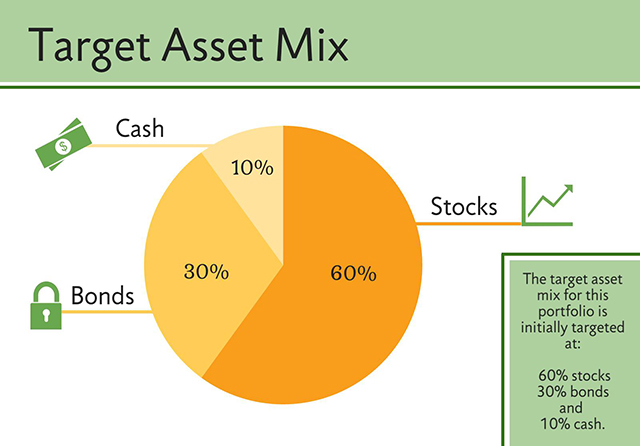

Like with credit, you should have a mix of investments.

This is called the asset mix.

The Best Asset Mix For You

An asset mix is significant.

It determines the level and types of risks you face, and also what you can earn.

It is tricky to find the right one, as it is very different for each person.

The best mix is also dependent on your age.

How far are you from retirement?

If you have decades to go, you can focus on maximizing long-term growth rather than risks.

However, it’ll be better to minimize those risks as you get closer to retirement.

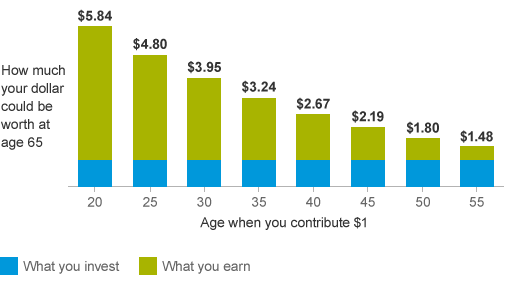

So When Is The Right Time To Start?

Regardless what plan you use, time is the secret to ending with large funds.

It’s recommended you should start saving when you start working and earning money.

In this chart, there is a 4 percent annual return.

It shows how the same contribution can have a different effect, depending on when you start it.

You can put in a small amount, but what age you start to invest it makes a huge difference.

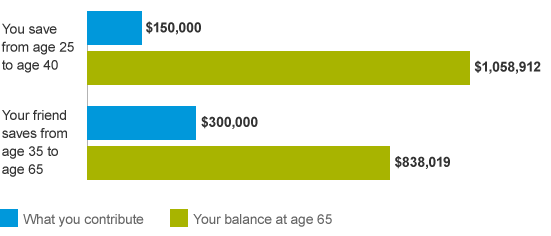

In this chart, the money you started with was half of the amount of your friend’s account.

You also put aside savings for half of the time.

But by age 65, you had much more funds.

The difference is that you began this process ten years earlier, and so your account was able to generate more interest over time.

Other Ways To Save

If you need more ways to save, or are worried your plan won’t work, there are tons of ideas on the internet.

For all money saving tips, the first is always to cut expenses.

“Out of sight, out of mind” is how the saying goes, right?

Turning expensive assets into funds can free up money as well.

Increase investment income by moving to a smaller home.

This also considerably cuts down on utility fees.

Is It Too Late Now?

It’s never too early to begin.

But it’s never too late either.

There are some ways for you to “catch up.”

Traditional retirement plans require time to see their full benefits.

Late starters can try some unconventional approaches instead.

One way is to buy direct ownership assets.

Examples include self-owned businesses and income-producing real estate.

What makes these different is that there are no mathematical limitations.

There is no interest rate with a maximum annual earning.

Of course, these have less certainty and more risk.

They are not highly encouraged unless you are desperate.

Look Over Your Retirement Plan

If all else fails, maybe you can change your expectations of retirement.

Though you might not like it, pushing back retirement is an option.

It gives you more time to contribute to savings, especially if you started late.

You can also try to transition gradually into retirement.

Rather than slamming down the breaks, ease into it.

This has the same effect as postponed retirement, but with less stress.

Some people never retire either.

Or they do, and then find a part-time job.

Being able to relax sounds like heaven to the stressed worker now.

But when you truly have nothing to do, it might become uncomfortable.

All in all, your personality and your hopes for the future shape your retirement plans.

It is strongly recommended to start saving as soon as you can.

But it’s never too late to begin your retirement fund.