Since the recession took place back in 2008 and 2009 there have been changes within the market for real estate.

2014’s competitive offers combined with the number of homes available to be purchased caused excitement for those selling their homes.

This year, the marketplace is a profoundly different place.

Individuals looking to buy homes can make use of the new realities taking place in the real estate market.

More Options Available

The real estate market in 2014 was created by some factors.

The return of the confidence of employment was one of the most critical factors to the 2014 real estate market.

The market experienced a rush.

Back then the demand to own a home was high.

An opportunity was presented for sellers to put their houses up for sale and they would receive offers from some families wanting to by their home.

They could just choose the offer that would provide them with the most amount of money.

This was during a time that developers had been out of the business of creating new homes for a few years.

Finding a location to build was a major obstacle for new home builders on the scene.

The resale market experienced a boost during this time, and new homes reached a premium.

There is a little over two months’ worth of inventory available, and the market is still ideal for sellers.

However, it is now a much easier process for a buyer to find whatever they are looking.

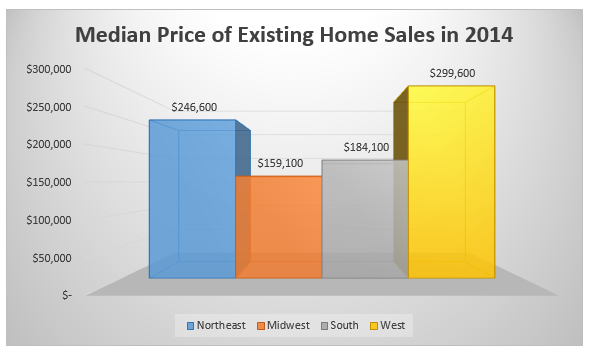

The following shows home sales performance in 2014 by region:

Interest Rates Are Stable

There were numerous predictions made that interest rates would rise.

However, the markets remain supportive of keeping interest rates low.

The following factors are indicative that the near future will not hold increases in the rate of interest:

- The instability of foreign economies

- Decisions that have been made within domestic markets

Even though indicators suggest that rates will remain low, it is important to remember that the rates have remained less than 4 percent for a while.

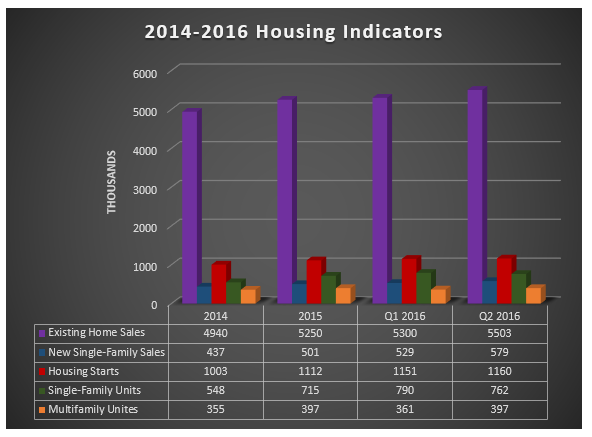

If you doubt that now is the time to buy a home, take a look at housing indicators for 2014-2016:

Programs aimed at minimizing the struggle for a down payment

One of the biggest issues faced by most homeowners is the ability to make the down payment.

This can cause homeowners to put off purchasing a home that they may desperately need.

However, there are other options available.

Instead of putting off the purchase, you can make use of some programs aimed at assisting in the process of being able to make a down payment.

These programs were created to help new potential owners get through the arduous task of trying to save money to be able to afford the expensive down payment for a home.

For example, housing corporations offer down payment assistance programs.

Some are aimed at assisting everyday retired military heroes obtaining at home.

Others are created to support professionals like teachers or police officers afford down payments.

There are other programs offering assistance with mortgage loans of up to five percent.

Some loans will even offer up to one hundred percent financing for properties that qualify for the programs.

The programs vary from location to location.

No matter where you are you can find a program that is able to assist you with your needs.

The Role of the Agent and the Role of Technology

Buyers that are new to buying a home and are smart equip themselves with knowledge before beginning the process of the purchase of a home.

These are the homeowners that have conducted research on the current conditions of the market.

They have the statistics and data that they need concerning homes and the different communities that will fit for what they are looking.

The playing field that exists between a person buying a home and the person selling a home is even thanks to technology.

However, you should never underestimate the role played by the agent when it comes to the success of buying a new home.

Now may be the time to buy, but the agency is critical to the success of the buyer.

You want to make sure that you are hiring an agent that is trustworthy and experienced to represent you throughout as you purchase a new home.

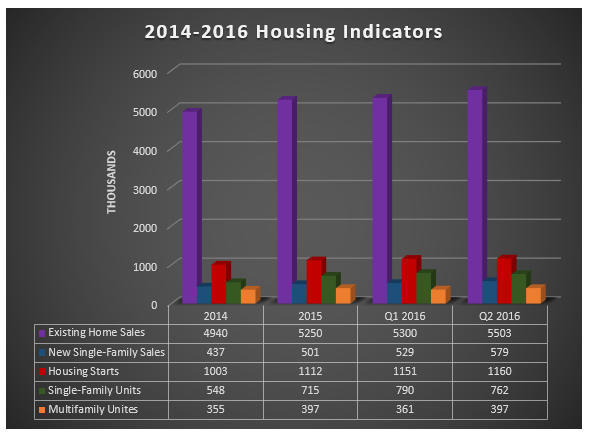

To know what the market looks like now, the median home prices from 2014-2016 are listed below.