Refinancing your existing interest rates on various loans is very important in many cases; especially with credit cards, you can often negotiate for a lower interest rate.

However, other times, refinancing can be a bad idea and get you into more financial hardship.

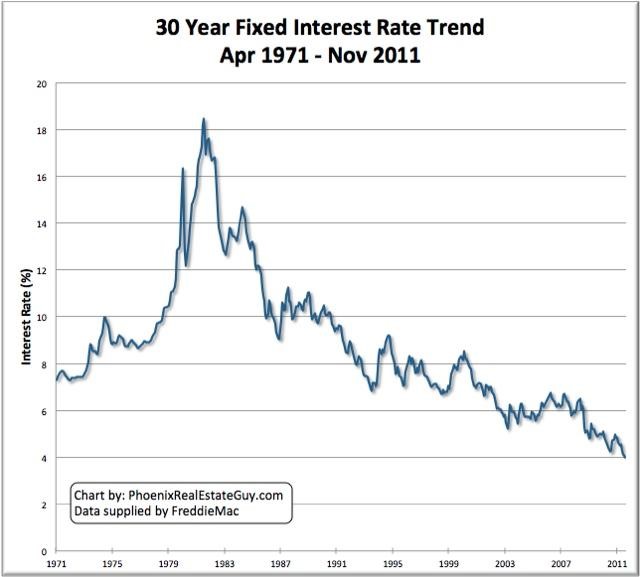

As the chart below shows, mortgage rates have been trending downward at a steady rate.

We are now experiencing a record low in interest rates, leading many people to want to refinance.

However, there are a few times when you should avoid attempting to refinance.

Sometimes, these moves can backfire.

It is important to follow these tips to avoid paying more in the long run.

If you are currently questioning whether to refinance, these five examples will help to illustrate when you should say to no to refinancing.

1. Refinancing in an attempt to pay off your loan in a shorter amount of time

It often happens that people eventually make a higher income than when they first financed their home.

This may make you think that you should pay off your mortgage sooner with your newly available earnings.

This is not necessarily the best path.

This works for some people, but it is usually best to simply make extra payments on your existing mortgage than to refinance entirely as you will face extra costs from the process of refinancing.

You can still save on overall interest this way.

Financial adviser Casey Fleming suggests figuring out monthly payments for your existing mortgage on the same timeline as your hypothetical new mortgage plan.

Multiply the amount by the number of payments, and you have the lifetime cost of the existing loan.

Do the same for the proposed loan, then compare them to do a true cost-benefit analysis.

Lenders will often encourage people to refinance when it is not necessary because obviously they profit from these refinancing transactions.

2. You need to change to an adjusted rate to make your rate lower

These mortgages are attractive because you have a low set interest rate for a set period of time (usually from one to seven years on average).

However, contrary to a fixed-rate loan, the ARM rate will increase to the market rate after that.

Interest rates are always bound to go up over time.

Only switch to an adjusted rate if you are sure you can shoulder the costs of interest if they were to increase.

Although, with a lower interest rate, you may be able to pay off your loan faster.

That would mean the future interest rates affect you less.

However, if you can’t pay it off before then, you will have added costs unnecessarily.

3. You plan on selling your house in the next few years

Refinancing is an expensive process.

If you can avoid it, it is usually in your best interest to just stick with your current mortgage.

If you are staying in your home for a while, you can bounce back from those costs.

But if you are going to sell your home soon, there is no point increasing your rates which will not benefit you in the long run.

The amount of time you live in your home is a very important consideration.

It may be worthwhile to look into getting an ARM.

This can dramatically lower your interest rate in the short term, which makes sense for impending home sellers.

As long as you can sell before the interest rates go up, you’re in the clear.

4. You are trying to refinance in order to lower your interest rate and offset the costs of refinancing

If you can’t lower your interest rate sufficiently to offset the costs, don’t refinance.

There is simply no point, and you will clearly be spending more money in the long run.

The costs are typically around 2% of the total home cost to refinance.

This is huge, especially for expensive homes.

Only if you can get some really great interest rates, it will not be worthwhile to refinance.

You may also be adding more years to your loan.

This may seem good if you are struggling to pay off your mortgage, but it is better to reduce the stressful years of paying off your home if possible.

You must look at the interest every month, the principal, and other factors for both the old loan and the new, to see if it is truly worth your while.

You may end up paying more to interest rates accidentally.

5. The costs outweigh the savings in the long run

This may seem obvious, but logic dictates through a basic cost-benefit analysis that if the costs outweigh the savings, you should not refinance, because:

- Refinancing may look good, but once you do the math, you may realize you will actually be spending more on interest.

- If you are trying to expand the payment period of your mortgage, you may be paying more in interest plus adding more years of paying off your home, causing stress.

- The interest plus the refinancing cost is the true cost of your loan, not just the cost of refinancing.

It takes careful consideration when deciding when and how to refinance.

Don’t be swayed by apparently low interest rates, because you may get swindled in the long term.

You must consider whether it is truly worth the time, effort, and stress.

Usually, simply making extra payments on your current mortgage will suffice to pay off your loan faster.