Many people work their entire lives waiting for the day they can retire. But if they’re don’t prepare the right way, retirement won’t be easy. This is the problem our country faces today. Less Americans are saving for retirement.

We could speculate about why less Americans are saving for retirement. We can either blame it on sentiment or the growing deficit between wages and rising costs for living.

If you blamed income for the problem, you might be on to something. It’s a challenge to save for retirement when Americans are struggling with their income and a higher cost of living. Now throw in the goal of 10 to 15 percent saved for retirement. That can make the option of saving completely out of the question.

Many employers offer a 401(k) with some type of matching program. But some employees don’t have faith in their employer’s’ matching program. They all share negative mindsets and then discourage each other based on the bad decisions they’ve made in personal 401(k)s.

Some Americans don’t like the idea of investing their money. An unreliable stock market scares potential investors from putting any of their money into an investment plan. Maybe most Americans aren’t educated on how to invest their money.

There are probably many reasons why less Americans are saving for retirement.But none of the reasons are an excuse for not saving for retirement.

We’ve rounded up some facts to show you how big of a problem it actually is.

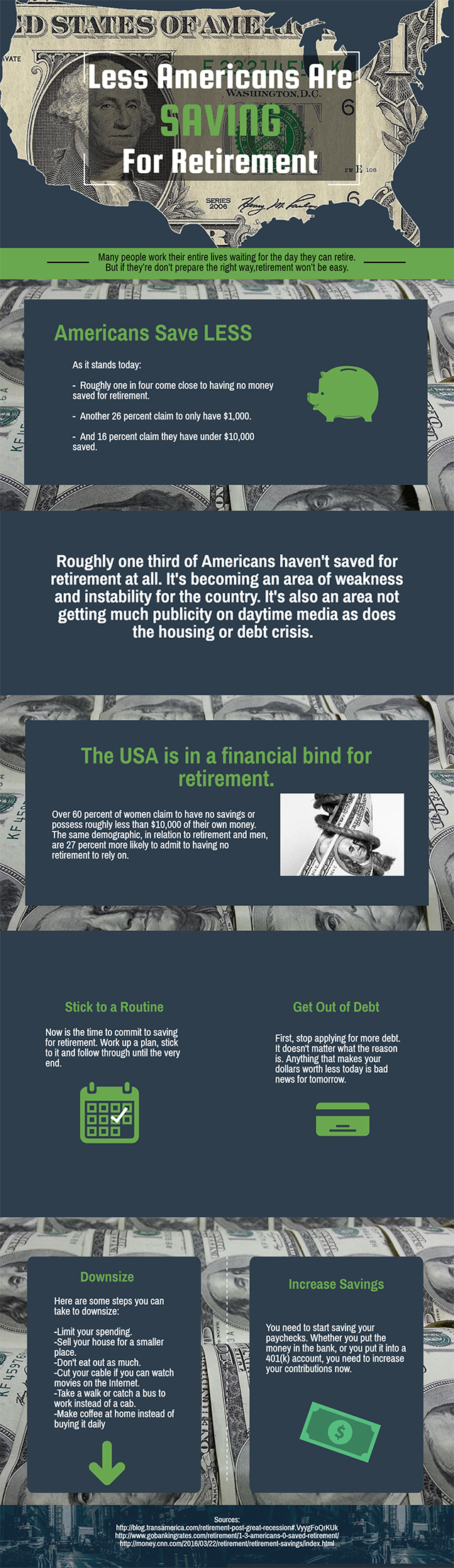

Americans Save Less And Less Americans Are Saving For Retirement

As it stands today:

- Roughly one in four come close to having no money saved for retirement.

- Another 26 percent claim to only have $1,000.

- And 16 percent claim they have under $10,000 saved.

What this means is that over 40 percent of Americans don’t have $15,000 saved for retirement. The numbers are staggering. Mind blowing to say the least.

When we begin looking into how this comes about among paid, U.S. workers, we consider their comments.

Majority say. …what’s stunting their ability to save is managing day to day expenses. But things do get worst. …if that wasn’t bad enough.

Roughly one third of Americans haven’t saved for retirement at all. It’s becoming an area of weakness and instability for the country. It’s also an area not getting much publicity on daytime media as does the housing or debt crisis.

The USA is in a financial bind for retirement.

Over 60 percent of women claim to have no savings or possess roughly less than $10,000 of their own money. The same demographic, in relation to retirement and men, are 27 percent more likely to admit to having no retirement to rely on.

Looking at these figures from an age perspective, and you’ll see more alarming details. The younger Millennials are more likely to have no savings. Baby Boomers have an 85 percent advantage over Generation X. Twice as many older Generation Y’s have between $10,000 and $49,000 saved for the days ahead.

But bad news still looming, we thought it best to share ways to boost your savings and get you out of the bind many are in.

Stick To A Routine

Now is the time to commit to saving for retirement. Work up a plan, stick to it and follow through until the very end. Your retirement is a long term plan that you can’t prepare for overnight. If you know you are behind in saving, then you need to act immediately.

We’ve provided some strategies for you below. These are the first steps you should take when you’re trying to increase your retirement savings.

Get Out of Debt

First, stop applying for more debt. It doesn’t matter what the reason is. Anything that makes your dollars worth less today is bad news for tomorrow. Your next step is to look at the total debt you have. That number needs to disappear as soon as possible. It makes no sense to finally reach retirement but still have debt.

You could even save a hefty sum only to put it in the debt collectors hands when you retire. Those who’ve been knocking on your door today.

Increase Savings

Increase your savings now. Especially if you know you’re behind at the moment. You need to start saving your paychecks. Whether you put the money in the bank, or you put it into a 401(k) account, you need to increase your contributions now. Try to save the money in something you don’t have easy access to. That way it makes it difficult for you to take money out before retirement.

Bring up your savings to at least 10 to 15 percent of your income if you haven’t already. If you have, increase that percentage even more.

Even a dollar a day increase adds up over time. Your investment, by sacrificing a little today, is about ensuring your livelihood in retirement.

Downsize

Now is the time to cut back. You’ve read the prior statistics. Based on the numbers, you might already fall into this category of Americans.

Know that you’re not alone. And there are many things you can do today to turn things around.

Here are some steps you can take to downsize:

- Limit your spending.

- Sell your house for a smaller place.

- Don’t eat out as much.

- Cut your cable if you can watch movies on the Internet.

- Take a walk or catch a bus to work instead of a cab.

- Make coffee at home instead of buying it daily

See it as an investment into the future and not for the current moment. You will be glad you did.

So if you didn’t know the retirement issues in our country before, now you know. Less Americans are saving for retirement. And the ones that have savings typically don’t have enough saved. This is an issue you need to tackle immediately. Start to find ways you can save today. If your employer offers a 401(k) match program, take advantage of that. Start a My RA account if you qualify.

Make sure you enjoy every year you have in retirement.