Most people could probably use some tips for buying a car. A car salesman making you feel stupid is not the best feeling in the world. Besides buying a home, buying a car is probably one of the biggest purchases you’ll end up making in life.

However, most people go into the car buying process unprepared or under informed. So we made up a list of tips for buying a car that will help you feel like an expert during the car buying process.

If you are a car buying rookie, then these tips will help make the process as smooth as possible. If you have purchased a car before, these tips for buying a car might show you what you did wrong last time.

So pay attention!

Here are 8 money-saving tips for buying a car:

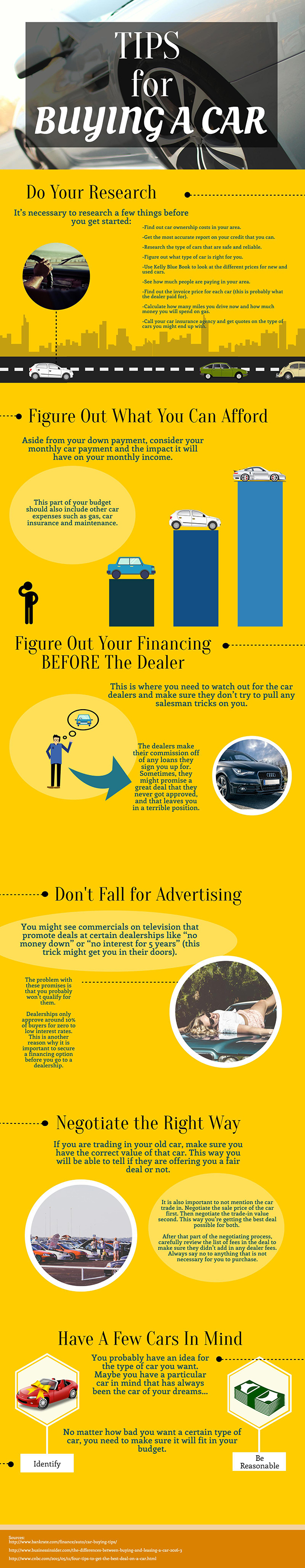

Do Your Research

It’s necessary to research a few things before you get started:

- Find out car ownership costs in your area.

- Get the most accurate report on your credit that you can.

- Research the type of cars that are safe and reliable.

- Figure out what type of car is right for you.

- Use Kelly Blue Book to look at the different prices for new and used cars.

- See how much people are paying in your area.

- Find out the invoice price for each car (this is probably what the dealer paid for).

- Calculate how many miles you drive now and how much money you will spend on gas.

- Call your car insurance agency and get quotes on the type of cars you might end up with.

Figure Out What You Can Afford

Aside from the down payment, your monthly car payment will make a drastic impact on your monthly income. It is important to keep the total cost of your car payments under 25% of your monthly income.

This part of your budget should also include other car expenses such as gas, car insurance and maintenance. Figure out how much you drive each year and get quotes on your potential cars from your insurance agency.

Have A Few Cars In Mind

You probably have an idea for the type of car you want. Maybe you have a particular car in mind that has always been the car of your dreams.

No matter how bad you want a certain type of car, you need to make sure it will fit in your budget. Many eager car buyers sign themselves up for car loans that they will never be able to pay off.

New Or Used? Leasing?

There are definitely pros and cons for choosing to buy a new car or a used one. You’re going to get you’re best value when you buy a used car. As soon as a brand new car drives off the dealership lot, the car’s value decreases fast. It’s possible to get a good deal on a slightly used car with a low amount of mileage on it.

The drawbacks of buying used is the higher interest rates and a shorter warranty period (if there was a warranty in the beginning). Not knowing the car’s history is a little intimidating too, we recommend choosing a certified preowned car.

Buying a new car means you will likely be paying more money over time. Depending on what your down payment is, you’ll be financing more money for a new car, and you’ll most likely pay more monthly. But there are some perks to buying a new car:

- Full warranty

- Lower interest rates

- Free maintenance

- Free roadside assistance in most cases

Leasing a car can sometimes be cheaper than buying a car. It is possible to own a new, high quality car for lower monthly payments. The only downside is you will not own the car.

Leasing is a good idea if you trade in your car every few years. You can always buy out of your lease at any point of the contract.

Figure Out Your Financing Before You Go To A Dealer

This is where you need to watch out for the car dealers and make sure they don’t try to pull any salesman tricks on you.

The dealers make their commission off of any loans they sign you up for. Sometimes, they might promise a great deal that they never got approved, and that leaves you in a terrible position.

It’s important that you find financing options with different banks or credit unions. Leverage these options with the one the dealer offers.

Don’t Fall For Advertising

You might see commercials on television that promote deals at certain dealerships like “no money down” or “no interest for 5 years” (this trick might get you in their doors). The problem with these promises is that you probably won’t qualify for them.

Dealerships only approve around 10% of buyers for zero to low interest rates. This is another reason why it is important to secure a financing option before you go to a dealership.

Test The Car As Long As You Want

Buying a car is usually a 5 or 10 year commitment (sometimes longer). So when it’s time for you to finally go to the dealership and go for a test drive, take as much time as you need. Set up an appointment or let them know you’re coming in.

Don’t feel like anyone is rushing you while you are testing out a potential future car. If you feel rushed, just ask for more time. Remember, they want to make the sale. This is also a good time to test out the seats and controls of the car.

Negotiate the Right Way

If you are trading in your old car, make sure you have the correct value of that car. This way you will be able to tell if they are offering you a fair deal or not.

It is also important to not mention the car trade-in. Negotiate the sale price of the car first. Then negotiate the trade-in value second. This way you’re getting the best deal possible for both.

After that part of the negotiating process, carefully review the list of fees in the deal to make sure they didn’t add in any dealer fees. Always say no to anything that is not necessary for you to purchase.

So there you have it.

Whether you’re shopping for your first car, or you’re looking for a better deal on your next car… Follow these tips for buying a car every time you’re on the prowl.

They will save you from most of the headaches that come from the process.